navigating the labyrinth of taxes can usually really feel like embarking on a treacherous journey, stuffed with twists and turns that can go away even essentially the most seasoned filers feeling misplaced. because the annual deadline approaches, the strain to guarantee accuracy whereas maximizing your refund will be overwhelming. But worry not—armed with the best information and methods, you may remodel this daunting job right into a manageable expedition. In this text, we’ll information you thru important suggestions and insights to show you how to unlock the full potential of your tax return, guaranteeing that you simply preserve more cash in your pocket and switch the tax season into an alternative fairly than a chore. Let’s chart a course via the world of deductions, credit, and customary pitfalls, so that you can emerge from tax season with confidence and a satisfying refund.

Understanding Tax Deductions and Credits for optimum Returns

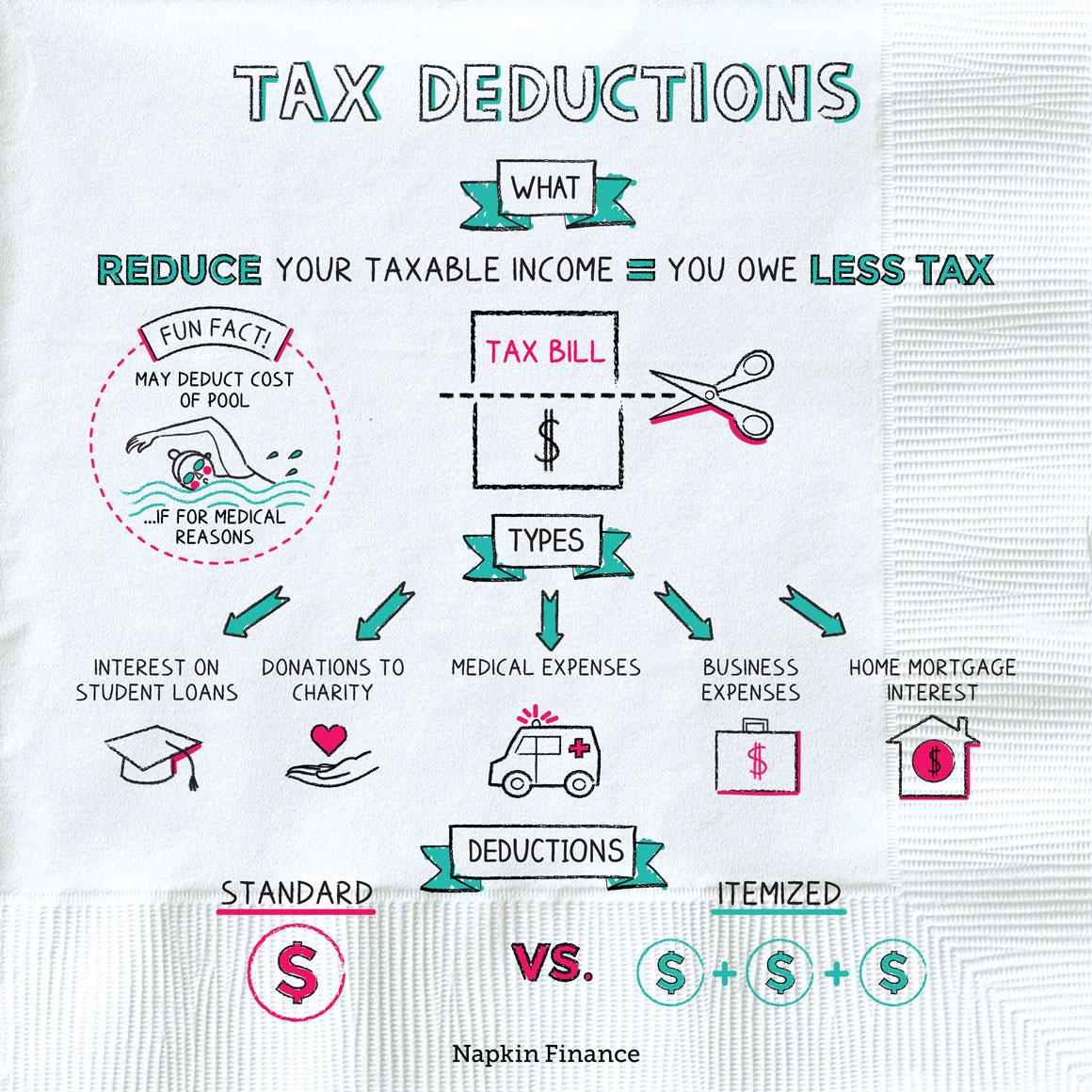

Understanding the intricacies of tax deductions and credit can considerably affect your total tax legal responsibility and potential refund. Deductions scale back your taxable earnings, whereas credit instantly scale back the quantity of tax you owe.Here are some crucial factors to contemplate:

- Standard vs. Itemized Deductions: Determine whether or not taking the usual deduction or itemizing your deductions yields a greater tax consequence. Itemized deductions could embody medical bills, mortgage curiosity, and property taxes.

- Tax Credits: Familiarize your self with tax credit for which chances are you’ll be eligible, such because the Earned Income Tax Credit and the Child Tax Credit. Unlike deductions, these can lead to vital reductions in your total tax invoice.

It’s important to preserve thorough information all year long to guarantee you may declare all attainable deductions and credit. Utilizing tax software program or consulting with a tax skilled can present personalised insights into maximizing your returns. Here’s a fast overview of some widespread deductions and credit:

| Deduction/Credit | Description | Potential Savings |

|---|---|---|

| Mortgage Interest Deduction | Interest paid on a house mortgage, lowering taxable earnings. | Varies primarily based on curiosity paid. |

| Child Tax Credit | Credit for dependents underneath 17, instantly lowering taxes owed. | Up to $2,000 per youngster. |

| Student Loan Interest Deduction | Interest paid on pupil loans, deductible from taxable earnings. | Up to $2,500 per 12 months. |

Essential Document Organization for Stress-Free Tax Filing

To make tax season smoother and much less intimidating, begin by gathering **important paperwork** that can kind the spine of your submitting course of. Organizing these supplies prematurely not solely helps keep away from last-minute scrambles but in addition ensures you don’t miss out on potential deductions. Key paperwork could embody:

- W-2s from employers

- 1099 types for freelance work or different earnings

- Receipts for deductible bills, resembling charitable donations

- Last 12 months’s tax return for reference

- Records of medical bills, if relevant

Next, contemplate making a easy submitting system, both bodily or digitally, to preserve observe of your paperwork. A neat strategy can contain a labeled folder or a devoted folder in your pc. Here’s a advisable construction:

| Category | Documents |

|---|---|

| Income | W-2, 1099, Bank Interest Statements |

| Deductions | Charitable Contributions, Medical Bills, Business Expenses |

| Previous Returns | Last Year’s tax Return |

This organized strategy ensures you could have each mandatory element at your fingertips, selling a assured and environment friendly submitting course of. Each class permits you to rapidly retrieve wanted data, guaranteeing that nothing important slips via the cracks as you embark on maximizing your refund.

Strategic Timing: When to File for Maximum Refund Potential

Timing is all the things, particularly when it comes to submitting your taxes. To optimize your refund potential, it’s important to perceive the benefits of submitting early versus ready till the deadline. By submitting early, you not solely get a bounce on the course of, however you additionally open the door to faster refunds, often sufficient inside only a few weeks. Additionally, submitting sooner might help you keep away from last-minute rushes, which can lead to errors or missed deductions. listed here are a couple of **advantages of submitting early**:

- **Quicker entry to your refund**

- **Reduced threat of tax identification theft**

- **More time to tackle potential points**

However, ready till the final attainable second can even supply benefits, notably in case you anticipate modifications in your monetary scenario.If you are uncertain about particular deductions or credit, holding off till later can enable you to collect higher documentation and guarantee no cash is left on the desk. Use the desk under to weigh some concerns for every strategy:

| submitting Early | Filing Late |

|---|---|

| Fast refunds | Updated monetary data |

| Less hectic | Improved documentation |

| Minimized threat of fraud | Potential modifications in deductions |

Common Mistakes to Avoid for a Smooth Tax Refund Process

To guarantee your tax refund course of goes off and not using a hitch, be aware of widespread pitfalls that may delay your refund or even lead to errors that require expensive corrections. **Failing to double-check your private info** is a frequent oversight; even a small discrepancy in your Social Security quantity or tackle can set off delays. Also, **neglecting to report all sources of earnings** can increase pink flags, leading to an audit or extra penalties. Always cross-check your earnings in opposition to your W-2s and 1099s to guarantee completeness.

Another widespread mistake is **ready till the final minute to file your taxes**. This can lead to hasty errors and missed deductions. Consider setting apart time effectively earlier than the deadline to arrange your paperwork correctly. Additionally, **overlooking obtainable tax credit and deductions** is a crucial error that coudl considerably scale back your potential refund. Here’s a fast comparability of often missed deductions:

| Deduction/credit score | Description | Potential Savings |

|---|---|---|

| Student Loan Interest | Interest paid on pupil loans may probably be deductible. | Up to $2,500 |

| Home Office Deduction | For freelancers and distant staff, a portion of your own home will be deductible. | Varies |

| Medical Expenses | Expenses exceeding a sure proportion of your earnings can be deducted. | Varies |

Q&A

**Q&A on “How to Navigate Taxes: Tips for Maximizing Your Refund”**

**Q1: Why is it vital to maximize my tax refund?**

**A:** Maximizing your tax refund can present you with additional funds that can be utilized for financial savings, paying off debt, or treating your self. It’s basically a monetary enhance, and who would not need a little more money of their pocket every 12 months?

**Q2: What are some widespread tax deductions I is likely to be lacking?**

**A:** Many taxpayers overlook deductions resembling medical bills, mortgage curiosity, schooling prices, and even charitable contributions. Deductions scale back your taxable earnings,which might lead to a bigger refund. Be aware of preserving information for all eligible expenditures all year long!

**Q3: How can I successfully observe my bills?**

**A:** The secret is group! Use apps designed for expense monitoring or merely preserve a devoted spreadsheet. Regularly updating this with receipts and related bills makes tax season rather a lot smoother. You can additionally categorize your bills into teams like journey, medical, or work-related, simplifying potential deductions.

**This autumn: Are there any tax credit that I ought to know about?**

**A:** Absolutely! Tax credit are even higher than deductions as a result of they instantly scale back your tax invoice. Popular credit embody the Earned Income Tax Credit (EITC), Child Tax Credit, and schooling credit. Familiarize your self with eligibility standards to see in case you qualify!

**Q5: How can submitting standing have an effect on my refund?**

**A:** Your submitting standing performs an important position in figuring out your tax charge,eligibility for deductions,and credit. Whether you are single, married submitting collectively, or head of family, every standing gives totally different advantages. Assess your scenario to select the standing that maximizes your monetary benefits.

**Q6: is it price hiring a tax skilled?**

**A:** If your tax scenario is advanced, hiring a tax skilled can present precious insights and methods you won’t contemplate by yourself. They might help determine deductions and credit you’ll have missed or navigate difficult tax legal guidelines, in the end maximizing your refund.

**Q7: what are some last-minute suggestions for this 12 months’s tax season?**

**A:** As the deadline approaches, guarantee you’re submitting precisely to keep away from expensive errors. Double-check all figures and paperwork, and don’t neglect to contemplate contributions to retirement accounts—these can delay your tax legal responsibility and enhance your refund! Lastly, file electronically to pace up your refund course of.

**Q8: when can I count on to obtain my tax refund?**

**A:** Typically, in case you e-file and select direct deposit, you may see your refund inside 21 days. However, this will range primarily based on a couple of components, together with in case you claimed any credit that require extra overview. Staying knowledgeable via your tax company can positively assist handle expectations.

By arming your self with the following pointers and insights, you’ll navigate tax season like a seasoned professional, maximizing your possibilities for a pleasant refund!

To Wrap It up

As we wrap up our exploration of tax navigation and maximizing your refund, it is clear that approaching tax season with preparation and information can remodel what many contemplate a frightening job into an empowering expertise. By leveraging obtainable deductions, staying organized, and contemplating skilled steerage, you may unlock the potential for a extra substantial refund. Remember,every greenback counts,and each saving issues.

As you embark in your tax journey, preserve this information shut at hand, and remind your self that your monetary well-being is well worth the effort. with the best strategy and a proactive mindset, you may flip tax time from a supply of hysteria into a possibility for monetary development. Here’s to a tax season that not solely meets your obligations but in addition units the stage for a brighter monetary future. Happy submitting!